USDA Financing

In addition to playing with a keen FHA otherwise Va loan, a decreased-money visitors can use to have an excellent USDA-backed home loan. These mortgage is created specifically for those who earn all the way down earnings compared to the local AMI and you can are now living in rural section.

HomeReady Otherwise Domestic You can easily Mortgage loans

Fannie mae and you will Freddie Mac was regulators-paid mortgage people. This new U.S. Congress created this type of organizations to help you shoot exchangeability to your country’s home loan system by purchasing and guaranteeing mortgage loans.

Together, they work to greatly help boost reduced-income citizens’ access to affordable houses. Particularly, its HomeReady and you can Domestic You’ll financial apps will benefit you when the you are searching to build riches by the owning a home.

Section 8 Homeownership Discount System

Low-earnings households who are in need of guidance can use towards the Point 8 homeownership system. It goals lower-income, handicapped and elderly those who you would like compatible safety.

In charge Part 8 renters who’ve a reputation on the-day repayments is discover a discount from the Housing Choice Coupon program. Low-earnings borrowers just who prior to now rented can use so it disregard in reducing its monthly mortgage payments, and make homeownership less costly.

HUD Houses

Property can go towards foreclosures for a lot of reasons. Brand new leading produce is when a borrower does not make mortgage repayments. not, it’s also you’ll be able to in the event the property taxes or property owners connection (HOA) costs wade unpaid.

When someone uses an FHA loan to find their house and you may fails to pay it off, HUD claims they. They then place the HUD households in the market for selling. These types of attributes much more accessible to reduced-income property and may even feature experts such as for instance prepaid service closing costs.

Sadly , it would be difficult to get you to definitely adopting the pandemic. A foreclosures moratorium then followed during that time considerably shorter the production of offered HUD residential property.

Special discounts

It’s possible to get a hold of unique income otherwise coupons to greatly help straight down to invest in will cost you. Imagine, particularly, the good Neighbor Across the street program.

This option offers an effective fifty% disregard into the HUD home to people in some professions. Accepted occupations positions is instructors, cops, firefighters and you can EMTs small loans North Courtland AL. Part of the requisite is that the candidate have to agree to live yourself for around three years as a way to market society creativity.

Fannie mae also offers a card using their HomePath Able Buyer program for participants’ settlement costs. The credit runs from step three% so you’re able to six% of home’s cost. Consumers is only able to utilize the closing cost guidelines if they purchase a HomePath home, no matter if.

When you’re you to definitely restrictions a purchaser, it may sooner benefit her or him. Talking about property surrendered to help you Federal national mortgage association by way of a deed in lieu off property foreclosure, which means that they tend to be in ideal status.

State And you will Regional Info

There are many different condition and you will regional governing bodies that offer special apps for first-time and low-income home buyers, out of knowledge in order to energy savings programs. New HUD preserves a list of this type of, along with counseling features that may help you discover the assistance you would like to have affordable and secure casing.

Trying to find a help system that is correct for you along with your household members should be difficult but interested in an affordable possessions to invest in normally end up being a lot more tricky. You might clarify your pursuit into following tips:

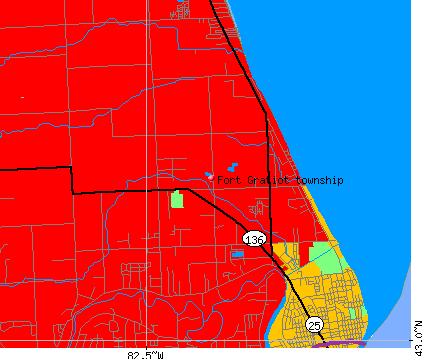

- Imagine less good communities. Purchasing property within the an up-and-upcoming, desirable neighborhood can be quite pricey. Rather, are household-browse inside the a local you to definitely has never experienced the new gentrification procedure.

- Identify your house budget ahead of time. Do not initiate travel features until you firmly know the way far home you really can afford. This preventative measure can prevent you from function your sights to the a property that is too costly.