An apr otherwise Apr is essential for the majority of sizes from credit. Find out more about just what Annual percentage rate means, Apr vs. APY, exactly what it opportinity for credit cards, and much more. [Duration- 2:14]

Highlights:

- An apr (APR) means the total yearly cost of borrowing money, illustrated once the a share.

- Contrasting APRs round the multiple financing or loan providers can help you see an educated options for your position.

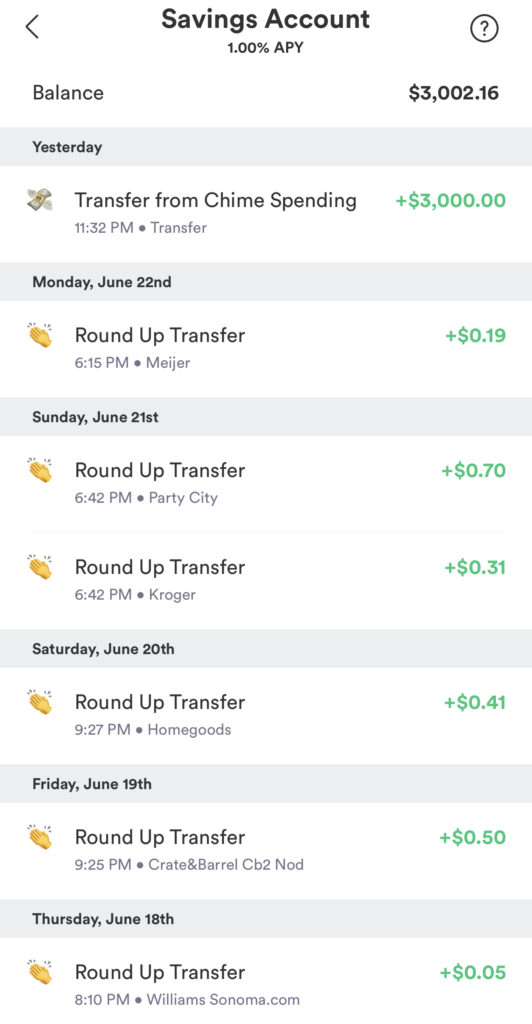

- Yearly commission produce (APY) is a lot like Apr but describes currency made during the a great savings account and other financial support, as opposed to the interest rate paid off into the that loan.

You really have heard of identity annual percentage rate (APR) while shopping getting a charge card, financial, car loan otherwise personal loan. An annual percentage rate was lots you to stands for the entire yearly rates of credit currency, conveyed as a portion of your own dominating loan amount.

The fresh new Annual percentage rate towards financing or mastercard aims to offer a whole image of how much they will set you back so you’re able to borrow money. Very, the new Annual percentage rate will be one of the most essential wide variety to help you envision when making an application for the newest credit.

Why does an annual percentage rate performs?

Once you borrow money, you usually have to pay straight back the original amount and a keen additional part of the mortgage number since notice. Their interest rate varies depending on the types of loan your favor and your particular financial predicament. The duration of the loan, your credit score and other situations can also be all the affect the count of great interest you only pay.

An annual percentage rate is the rate of interest for a whole year, along with one will cost you or fees of your loan. It means an apr gift suggestions an even more complete picture of exactly what you’ll pay money for the borrowed funds for each and every yearparing APRs across multiple fund or lenders makes it possible to find the best choices for your own disease.

To have playing cards, in which attention is indicated per year, brand new conditions Apr and you may interest can be used interchangeably. A credit card Apr will not typically become most fees. You need to remember that you might prevent paying rates of interest on the mastercard instructions, given you pay out of your balance timely monthly.

Apr vs. interest

In the context of financial, vehicles, private and other variety of funds, the terms and conditions Annual percentage rate and you will interest try similar although not the same.

Mortgage loan is only the rates you have to pay so you can acquire money, conveyed just like the a share, and will not is any extra charges connected with the borrowed funds. Attention can be charged a year, monthly or even every single day.

Simultaneously, an annual percentage rate signifies their rate of interest for the whole year. Together with, an apr includes a lot more costs connected with a loan. For example, on home financing, brand new Annual percentage rate will normally mirror not just the rate you are being recharged also any closing costs, origination costs, agent costs or other expenses associated with protecting a loan.

When comparing funds side-by-side, an apr constantly offers consumers a larger picture of the true will set you back than just the interest rate. For this reason, an annual percentage rate will also constantly become higher than mortgage, even when this isn’t always the outcome.

The thing that makes new Apr extremely important?

When it comes time to apply for the new credit, it’s a good idea to be familiar with what the Apr was and you will how it reflects exactly what you can easily pay over the longevity of the fresh new mortgage.

APRs are essential as they can make it easier to compare loan providers and you may loan possibilities. As well as, credit card companies are required to reveal the newest Annual percentage rate ahead of providing a cards and on month-to-month comments.

Exactly what influences their Annual percentage rate?

The latest Annual percentage rate varies according to the lender or collector. Although not, the credit scores can affect the costs you might be given. When the possible loan providers and you may creditors pick an eye on responsible borrowing behavior and thought your a minimal-risk borrower, you loans in Hartford could discovered a lesser interest, that can basically lessen the Annual percentage rate.

Annual percentage rate compared to APY: What’s the variation?

- Annual percentage rate stands for the entire yearly price of borrowing money, expressed since the a share, and has the eye you only pay to your financing.

- APY refers to the total amount of money you get into the a family savings and other funding, taking into consideration material appeal.

Material desire happens when you have made appeal not simply on your dominating coupons equilibrium, but also on the people past interest income. A simple interest on a savings account generally will not mirror substance interest. Therefore, APY should be a useful tool since it offers a over image of just how much their coupons you will grow throughout the years.

Make sure to continue APY in your mind when you’re trying to find yet another savings account or investmentparing the newest APY across additional accounts helps you result in the most suitable choice possible for debt existence.