Consumers default for assorted causes. Most of the time, individuals default by the failing to make costs required beneath the contract, but standard might result out-of a citation of every condition in the borrowed funds. Such as, failing to pay taxation toward property can result in standard, given that you will failing continually to insure the home, failing continually to hold the property within the a fix, or even in some instances, animated the property without any lender’s permission.

Judicial step ‘s the just property foreclosure means in certain claims. A normal judicial foreclosure concerns a lengthy number of steps: the latest submitting from a property foreclosure complaint and notice, the service regarding processes into the events whoever passions will suffer by the an official continuing, a hearing ahead of a court or a king within the chancery who records for the judge, brand new entry away from a great decree or judgment, a notification out-of product sales, a public foreclosure sales conducted from the an excellent sheriff, and also the article-sale adjudication to what vibe of your own foreclosure continues. Brand new debtor can also be end foreclosure by the refinancing the debt and getting latest towards costs, thus when you’re a judicial foreclosures are time consuming, it provides large due techniques and potential getting removal

Into the jurisdictions which do not behavior judicial foreclosure, the mortgage owner have a contractual power to foreclose market mortgaged assets. Whenever you are a legal wouldn’t review that it business, claims enforce tight requirements toward non-official foreclosures. Like, for the Arkansas, the loan owner must document a notification away from standard towards the state records office and should offer the house or property with no faster than just two-thirds of the appraised worthy of.

A borrower comes with the correct away from redemption, for example he is able to recover the home through to the foreclosure is completed if you are paying off the home loan any time prior so you can property foreclosure.

Numerous states has enacted rules permitting home financing debtor to recoup it even shortly after a foreclosure selling. This post-property foreclosure redemption can simply end up being exercised having a small quantity of big date whether or not, and you will rules are different by the county. Adopting the mortgage crisis from 2008-2009, of several says enacted laws restricting the new rights out of lenders to foreclose with the land. Specific says wanted lenders so you’re able to negotiate which have individuals in standard in the good faith to modify new terms of the borrowed funds and you can stop property foreclosure.

Into government top, the latest Resident Value and you may Balances Package will bring a debtor that is at the rear of on the mortgage repayments the means to access lowest-costs refinancing mortgage selection. That it laws has actually assisted an incredible number of Western homeowners endangered having foreclosures by simply making loan providers guilty of lowering complete monthly obligations so you can good proportion of your borrower’s income and you may demanding banking companies to change loans to aid a debtor will still be latest towards the money.

An effective dragnet clause can be so named because “drags” throughout almost payday loan Crowley every other obligations that has been, otherwise would-be, obtain amongst the debtor additionally the financial

An alternative you are able to capital technique is to do a deed regarding faith. An action of faith is like home financing because it guarantees houses in order to safe a loan. not, in the place of a mortgage, in which name toward equity stays from the debtor and helps to create an effective lien on the a home in support of the fresh new creditor, a deed out of believe conveys term so you can a third party known because “trustee.” The brand new trustee holds the fresh label in the believe towards lender designated as the beneficiary. The latest deed out of believe protects installment of your own loan produced by the fresh promissory notice and you can pledges the borrower’s overall performance from the carrying the root possessions as the security. In case the debtor non-payments for the financial, new trustee are available the newest land and provide the latest product sales continues towards the bank so you can offset the borrower’s kept financial obligation.

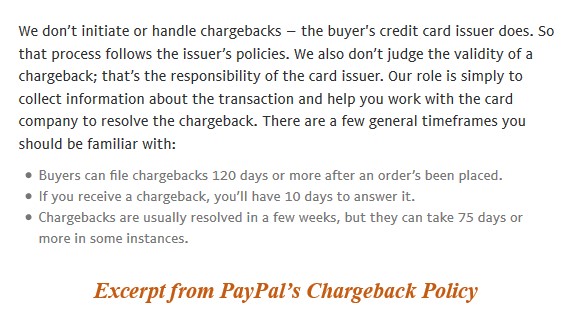

This type of regulations tend to demand waiting symptoms all the way to 120 months just before a lender can be foreclose for the a home

A valid foreclosure deals extinguishes the borrower’s ownership liberties and you may divests every junior encumbrances into the property, definition every after that mortgage loans, easements, liens, written following go out of your home loan into the default is ended during brand new business. A national tax lien, although not, can’t be divested by way of foreclosure unless the loan owner offers the Internal revenue service at the very least twenty-five days’ observe of one’s marketing.