- Firefighter or EMT: Should be utilized by a national, condition, local, or tribal government’s flame department otherwise disaster medical functions responder device.

Are eligible, you have got to work with the newest revitalization town the spot where the house is situated. Revitalization elements are reduced-income portion having lowest homeownership cost and you can a lot of HUD-foreclosed attributes.

There are no income or borrowing from the bank requirements for the program, you will need to see the prerequisites so you’re able to be eligible for home financing to buy your house. Having FHA mortgage loans, this generally form you will need a credit history with a minimum of 580 and you can a loans-to-earnings ratio less than 43%.

If you have owned a property in past times season, you are not entitled to this choice. Once you have purchased your GNND domestic, you’re going to have to remain in it for a few age since your first house – or even, you’re going to have to pay back the brand new discount amount.

Possessions requirements

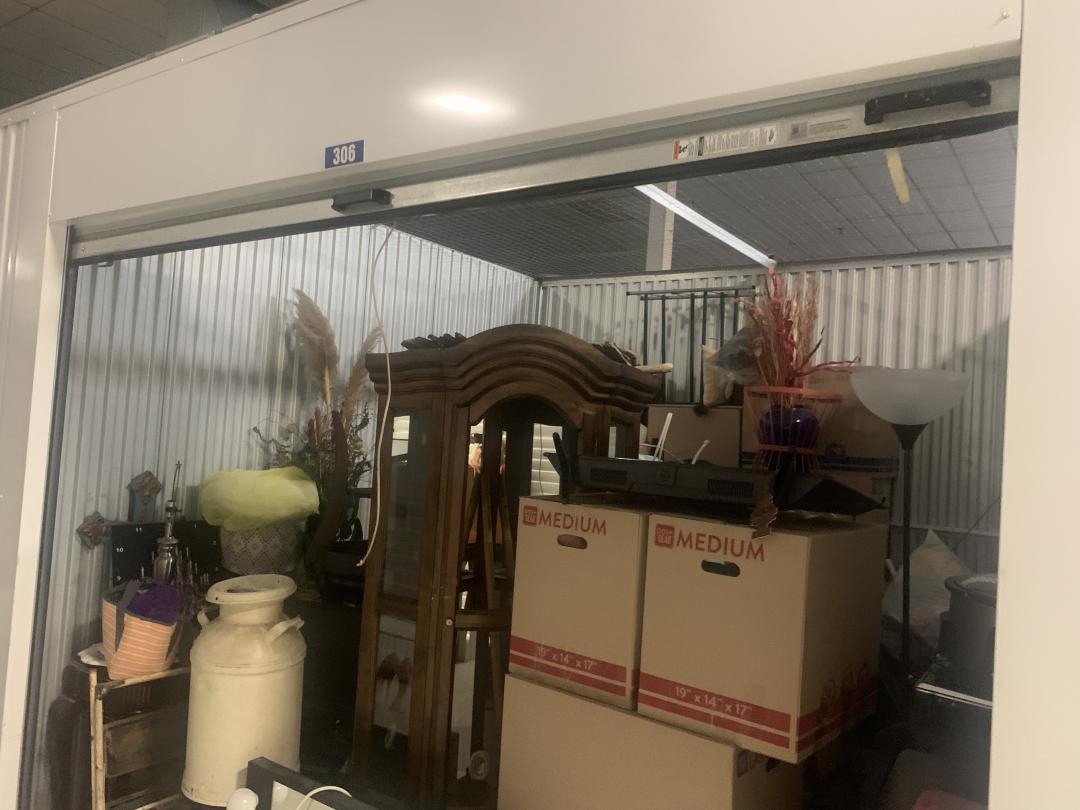

Don’t assume all domestic on the market can be purchased in the an excellent disregard from this system; merely specific HUD property meet the criteria. Having good HUD home, the particular owner in the first place ordered the property with an FHA mortgage, upcoming ran on the foreclosure.

Remember that once you purchase a foreclosed property, you are to find it is actually. This means that it is bought in their latest reputation. When the you can find biggest points, you’ll be responsible for and make fixes, that may get high priced. You might envision taking a repair financing particularly a keen FHA 203(k) financial, and that lets you move resolve costs to your mortgage.

Select an eligible possessions

Merely HUD house which can be when you look at the revitalization parts qualify having GNND, thus index because of it program is generally extremely limited, in just a few belongings found in the us at an effective big date. You can view the readily available HUD-had qualities on HUD Family Store.

When you’re capable of getting a property you’re interested in, you’ll want to work quick, given that GNND homes are only obtainable to have 7 days before they are listed to your average man or woman so you can quote into.

You’ll work with an effective HUD-entered representative add your bid. When the several some one fill in a bid to own an excellent GNND family, the customer was picked via arbitrary lotto.

“You will find various Good-neighbor Next door home you to definitely no body submits its term toward lottery attracting into in addition they basically diverted over to anyone list within full price,” Arrant says. “If a person person got place the identity inside the, it would’ve got a great 100% chance of effective the new lottery.”

Should your bid is chosen and you move on into the pick, HUD will give an effective “hushed 2nd” home loan to your assets which takes care of the brand new discount amount. Therefore, when the a house was indexed at $100,000, HUD will cover $50,000 and you may get home financing into the left count (minus their down-payment).

HUD often release their mortgage after you have lived in the home since your top home for three decades, which means that you get the fresh deal amount back to security. For folks who promote our home through to the 36 months try upwards, you’ll have to afford the 2nd financial count returning to HUD.

Application steps

For the kept buy matter, you need a home loan, https://paydayloanalabama.com/semmes/ which you can cope with people lending company you would like. And although the program provides for in past times FHA-recognized functions, you don’t need to fool around with an FHA mortgage to become listed on.

- Fill out new lender’s application. This calls for info about your cash, money, and you can a career.

- Submit documents. We are going to go a lot more for the it lower than.

- Get household appraised. This is towards the lender’s benefit – to be sure the house is worth what you are credit because of it.